In a recent report, Citi analysts have stated that Nvidia shares will remain stuck this year, citing concerns over macroeconomic challenges and potential headwinds for the semiconductor industry. This announcement has raised significant questions among investors about the future prospects of Nvidia's stock performance. As one of the leading companies in the tech sector, Nvidia's stock movements have always been a topic of interest for market watchers.

The semiconductor giant, Nvidia, has been at the forefront of innovation in artificial intelligence, gaming, and data center solutions. Despite its strong track record, the company's shares may face stagnation due to several factors outlined by Citi. In this article, we will delve into the reasons behind Citi's forecast and explore what it means for Nvidia investors.

Understanding the market dynamics and analyzing expert opinions is crucial for making informed investment decisions. This article aims to provide a detailed analysis of Citi's stance, backed by data and insights from reliable sources, to help investors better understand the situation surrounding Nvidia's stock performance this year.

Read also:Kyle From Hells Kitchen Is He Trans Unveiling The Truth

Table of Contents

- Citi's Report on Nvidia Shares

- Overview of Nvidia Corporation

- Macroeconomic Factors Impacting Nvidia

- Industry Headwinds Facing Nvidia

- Nvidia's Stock Performance in Recent Years

Analyst Predictions and Market Sentiment

- Strategies for Investing in Nvidia Amid Uncertainty

- Impact of AI on Nvidia's Future Growth

- Data Center Sector Trends and Nvidia's Role

- Conclusion and Next Steps for Investors

Citi's Report on Nvidia Shares

Citi's recent report suggests that Nvidia shares may remain stagnant throughout the year, citing macroeconomic factors and industry-specific challenges. According to the analysts, the semiconductor industry is facing headwinds that could hinder Nvidia's ability to deliver significant growth in the near term. While Nvidia remains a dominant player in the tech space, the current market conditions may limit its stock performance.

The report highlights several key concerns, including rising interest rates, global economic uncertainty, and supply chain disruptions. These factors could impact Nvidia's revenue growth and profitability, leading to a potential stagnation in its stock price. Investors are advised to carefully evaluate these risks before making any investment decisions.

Overview of Nvidia Corporation

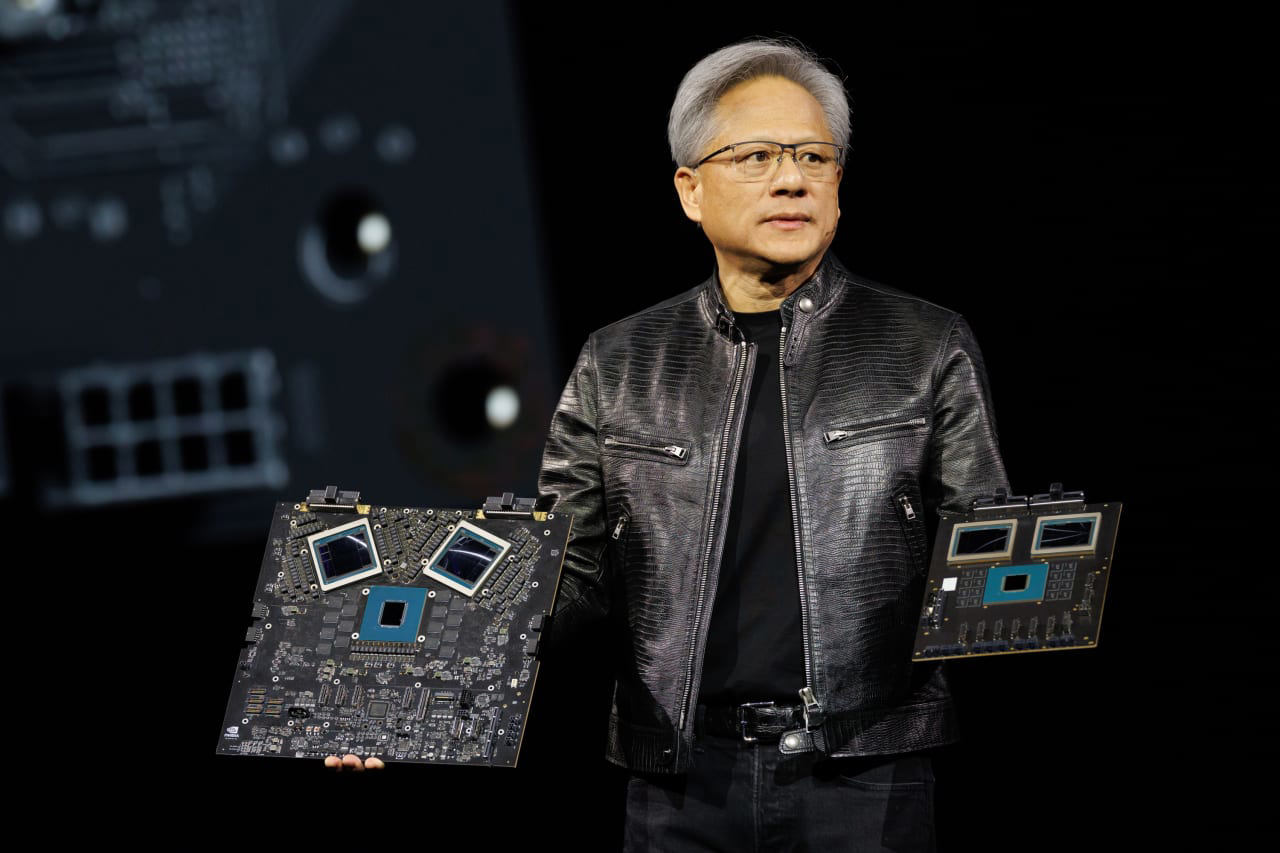

Nvidia Corporation, founded in 1993, is a global leader in visual computing technologies and AI innovation. Known for its powerful graphics processing units (GPUs), Nvidia has revolutionized industries ranging from gaming to data centers and autonomous vehicles. The company's commitment to cutting-edge technology has positioned it as a key player in the rapidly evolving tech landscape.

Key Business Segments

- Gaming: Nvidia's GPUs power high-performance gaming systems worldwide.

- Data Center: Nvidia provides advanced solutions for AI, machine learning, and cloud computing.

- Professional Visualization: The company offers specialized products for designers and engineers.

- Automotive: Nvidia is at the forefront of developing self-driving car technology.

Macroeconomic Factors Impacting Nvidia

The global economy plays a significant role in shaping the performance of tech companies like Nvidia. Rising interest rates, inflation, and geopolitical tensions can all contribute to market volatility. In the current economic climate, investors are becoming increasingly cautious, which could affect Nvidia's stock price.

Additionally, consumer spending on tech products has slowed down in recent months, impacting demand for Nvidia's GPUs. As the global economy continues to navigate uncertain waters, Nvidia may face challenges in maintaining its growth trajectory.

Industry Headwinds Facing Nvidia

While Nvidia's technological prowess is unmatched, the semiconductor industry as a whole is experiencing several headwinds. Supply chain disruptions caused by the pandemic and geopolitical tensions have led to shortages of critical components. This has affected production timelines and increased costs for companies like Nvidia.

Read also:Patrick Swayze Cause Of Death A Comprehensive Look At His Life Legacy And Final Days

Moreover, increased competition in the AI and data center sectors could pose challenges for Nvidia. Rival companies are investing heavily in research and development, aiming to capture a larger share of the market. Nvidia must continue innovating to maintain its competitive edge.

Nvidia's Stock Performance in Recent Years

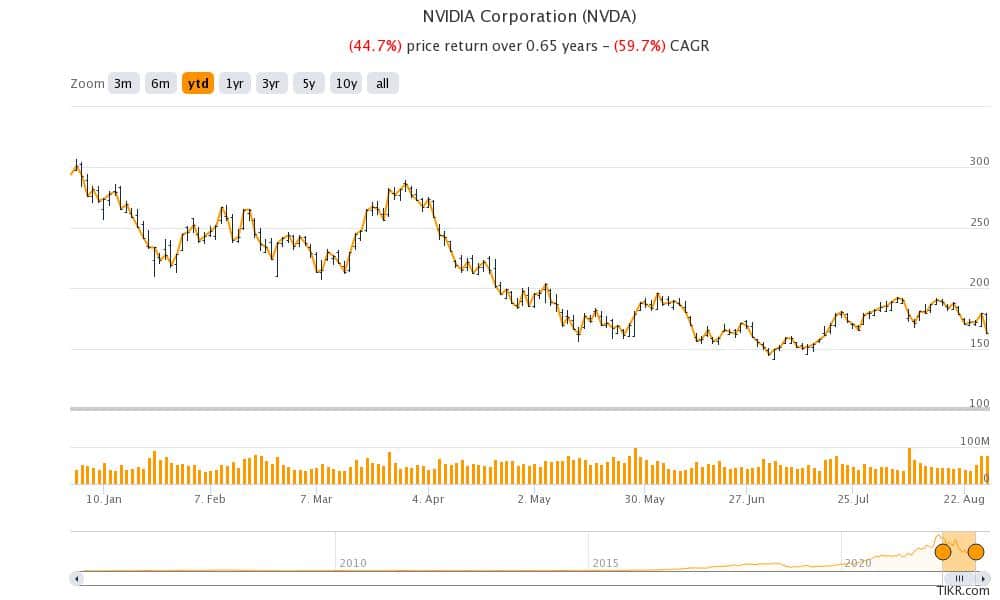

Over the past few years, Nvidia's stock has experienced remarkable growth, driven by its success in AI and data center markets. However, recent market conditions have led to volatility in its stock price. According to historical data, Nvidia's stock price has shown significant fluctuations in response to macroeconomic and industry-specific factors.

Investors are closely monitoring Nvidia's quarterly earnings reports to gauge its performance. While the company has consistently delivered strong results, the current market environment may impact its ability to sustain this momentum.

Analyst Predictions and Market Sentiment

Varied Opinions Among Analysts

Analyst opinions on Nvidia's stock performance this year are mixed. While some experts agree with Citi's forecast, others believe that Nvidia's innovative capabilities and strong market position will help it overcome current challenges. Market sentiment remains divided, with some investors optimistic about Nvidia's long-term prospects and others more cautious.

A survey of top financial analysts reveals differing views on Nvidia's stock potential. Some predict a rebound in the second half of the year, while others caution against overestimating the company's ability to navigate the current market conditions.

Strategies for Investing in Nvidia Amid Uncertainty

Investing in Nvidia during a period of uncertainty requires a well-thought-out strategy. Diversification is key to managing risk, and investors should consider allocating their funds across multiple sectors. For those interested in Nvidia, a long-term investment approach may be more suitable, as the company's track record suggests strong growth potential over time.

Additionally, staying informed about market trends and Nvidia's developments can help investors make better decisions. Regularly reviewing financial reports and industry news can provide valuable insights into the company's performance and future prospects.

Impact of AI on Nvidia's Future Growth

Artificial intelligence continues to be a driving force behind Nvidia's growth. The company's GPUs are widely used in AI applications, from natural language processing to autonomous vehicles. As AI adoption increases across industries, Nvidia is well-positioned to benefit from this trend.

However, the pace of AI development and its impact on Nvidia's revenue streams remain uncertain. Investors should closely monitor advancements in AI technology and their implications for Nvidia's business. The company's ability to innovate and adapt to changing market conditions will be crucial for its future success.

Data Center Sector Trends and Nvidia's Role

The data center sector is experiencing rapid growth, driven by increasing demand for cloud computing and AI solutions. Nvidia's dominance in this space is a key factor in its overall success. The company's GPUs are integral to data center operations, providing the processing power needed for complex computations.

As the data center sector continues to evolve, Nvidia must stay ahead of the curve by developing new technologies and expanding its product offerings. Collaborations with major tech companies and investments in research and development will be essential for maintaining its leadership position.

Conclusion and Next Steps for Investors

In conclusion, Citi's report on Nvidia shares highlights the potential challenges the company may face this year. While macroeconomic factors and industry headwinds could impact Nvidia's stock performance, the company's strong track record and innovative capabilities provide reasons for optimism. Investors should carefully evaluate the risks and opportunities before making any investment decisions.

We invite readers to share their thoughts and insights in the comments section below. For more information on Nvidia and the tech industry, explore our other articles. Stay informed and make data-driven decisions to achieve your investment goals.

Data sources: Bloomberg, Reuters, Nvidia Investor Relations