Investing in Tesla (TSLA) has become one of the most talked-about financial decisions in recent years. With its rapid growth and innovation, Tesla has captured the attention of investors worldwide. Whether you're a seasoned investor or just starting, understanding the TSLA stock chart is crucial to making informed decisions. This guide will walk you through everything you need to know about Tesla's stock performance and how to interpret its charts.

As one of the leading companies in the electric vehicle (EV) industry, Tesla continues to set trends and break records. Its stock chart reflects the company's dynamic nature, showcasing periods of rapid growth, volatility, and stability. By analyzing the TSLA stock chart, investors can gain insights into market sentiment, trends, and potential investment opportunities.

In this article, we will delve into the intricacies of the TSLA stock chart, providing you with valuable information to help you navigate the stock market effectively. Whether you're interested in day trading, long-term investing, or simply staying informed about Tesla's performance, this guide will serve as a comprehensive resource.

Read also:Kensley Pope Unveiling The Rising Star Of Social Media

Table of Contents

- Introduction to TSLA Stock

- How to Read TSLA Stock Charts

- Key Indicators in TSLA Stock Charts

- Historical Data and Trends

- Understanding Market Volatility

- Long-Term Investing in TSLA

- Short-Term Trading Strategies

- Factors Affecting TSLA Stock Performance

- Risk Management in TSLA Investments

- Future Outlook for TSLA Stock

Introduction to TSLA Stock

TSLA stock represents the publicly traded shares of Tesla, Inc., a company renowned for its innovative approach to electric vehicles, energy storage solutions, and renewable energy products. Since its initial public offering (IPO) in 2010, Tesla's stock has experienced significant fluctuations, reflecting both the company's successes and challenges.

Why TSLA Stock Matters

TSLA stock is not just a financial instrument; it symbolizes the broader shift toward sustainable energy and electric transportation. Investors are drawn to Tesla due to its visionary leadership, technological advancements, and commitment to sustainability. Understanding TSLA stock charts is essential for anyone looking to capitalize on these trends.

How to Read TSLA Stock Charts

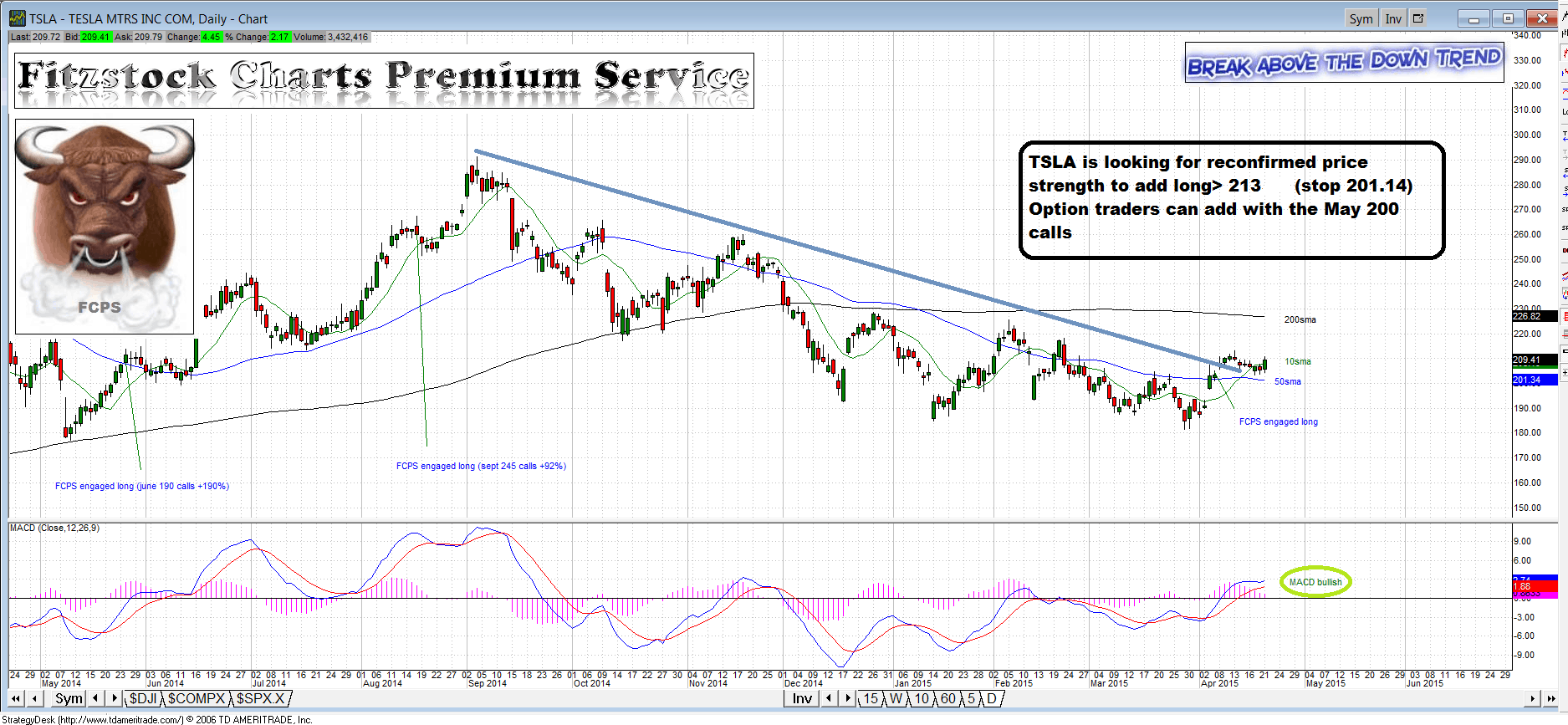

Reading TSLA stock charts involves analyzing various components that provide insights into the stock's performance over time. These charts typically include price movements, volume, and technical indicators that help investors make data-driven decisions.

Components of a Stock Chart

- Price Movement: The most basic element of a stock chart, showing the opening, closing, high, and low prices over a specific period.

- Volume: Indicates the number of shares traded during a given period, offering clues about market activity and investor interest.

- Technical Indicators: Tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) help identify trends and potential buy/sell signals.

Key Indicators in TSLA Stock Charts

Key indicators play a crucial role in interpreting TSLA stock charts. These tools help investors identify patterns, trends, and potential turning points in the stock's performance.

Popular Indicators for TSLA Stock

- Moving Averages: Smooth out price data to form a trend-following indicator, commonly used to identify support and resistance levels.

- RSI (Relative Strength Index): Measures the speed and change of price movements, helping to determine whether a stock is overbought or oversold.

- Bollinger Bands: Indicate volatility by plotting two standard deviations away from a simple moving average, providing insights into potential price breakouts.

Historical Data and Trends

Examining historical data is vital for understanding the long-term trends of TSLA stock. By analyzing past performance, investors can identify patterns that may influence future movements.

Key Historical Milestones

- IPO in 2010: Tesla's initial public offering marked the beginning of its journey as a publicly traded company.

- Stock Split in 2020: A 5-for-1 stock split increased accessibility for retail investors, boosting trading volume and interest.

- Entry into S&P 500: In December 2020, Tesla joined the S&P 500 index, further solidifying its position as a dominant force in the market.

Understanding Market Volatility

TSLA stock is known for its volatility, which can be both an opportunity and a risk for investors. Understanding the factors contributing to this volatility is crucial for making informed investment decisions.

Read also:How Was Rihanna Discovered The Inspiring Story Behind Her Rise To Fame

Causes of Volatility

- Market Sentiment: Positive or negative news about Tesla, such as earnings reports or product announcements, can significantly impact stock prices.

- Economic Conditions: Broader economic factors, including interest rates and inflation, also influence TSLA stock performance.

- Geopolitical Events: Global events, such as trade tensions or regulatory changes, can create uncertainty and affect Tesla's stock price.

Long-Term Investing in TSLA

For those considering long-term investments in TSLA, understanding the company's fundamentals and growth potential is essential. Tesla's commitment to innovation and sustainability positions it as a strong candidate for long-term success.

Long-Term Growth Drivers

- Expanding Product Portfolio: Tesla continues to introduce new vehicles and energy products, broadening its market reach.

- Global Expansion: With manufacturing facilities in multiple countries, Tesla is well-positioned to capitalize on international demand.

- Technological Leadership: Tesla's investment in cutting-edge technology, such as autonomous driving and battery innovation, sets it apart from competitors.

Short-Term Trading Strategies

Short-term traders focus on leveraging TSLA stock's volatility to generate quick profits. By employing specific strategies and tools, traders can navigate the stock's fluctuations effectively.

Effective Trading Strategies

- Day Trading: Involves buying and selling TSLA stock within a single trading day, capitalizing on intraday price movements.

- Swing Trading: Aims to capture gains over a few days to several weeks by identifying short-term trends and patterns.

- Technical Analysis: Utilizes charts and indicators to predict price movements and identify optimal entry and exit points.

Factors Affecting TSLA Stock Performance

Several factors influence TSLA stock's performance, ranging from internal company developments to external market conditions. Understanding these factors is crucial for assessing the stock's potential.

Internal and External Factors

- Company Earnings: Tesla's quarterly financial reports provide insights into its revenue, profitability, and growth prospects.

- Regulatory Environment: Government policies and incentives related to electric vehicles and renewable energy can impact Tesla's business.

- Supply Chain Challenges: Issues such as semiconductor shortages or raw material price fluctuations can affect production and costs.

Risk Management in TSLA Investments

Investing in TSLA stock comes with inherent risks, but effective risk management strategies can help mitigate potential losses. Diversification, position sizing, and stop-loss orders are key tools for managing risk.

Risk Management Techniques

- Diversification: Spreading investments across multiple assets reduces exposure to any single stock's volatility.

- Position Sizing: Allocating a specific percentage of your portfolio to TSLA stock helps control risk.

- Stop-Loss Orders: Automatically selling shares if the stock price falls below a predetermined level can limit losses.

Future Outlook for TSLA Stock

The future of TSLA stock looks promising, driven by Tesla's continued innovation and expanding market presence. However, investors should remain cautious and monitor developments closely to make informed decisions.

Potential Future Trends

- Electric Vehicle Adoption: As global demand for EVs grows, Tesla is well-positioned to benefit from this trend.

- Energy Solutions: Tesla's focus on solar panels, battery storage, and energy management systems presents additional growth opportunities.

- Technological Advancements: Continued progress in autonomous driving and battery technology could further enhance Tesla's competitive advantage.

Conclusion

In summary, understanding the TSLA stock chart is essential for anyone interested in Tesla's financial performance. By analyzing historical data, key indicators, and market trends, investors can make informed decisions about their TSLA investments. Whether you're focused on short-term trading or long-term growth, staying informed and managing risk are critical components of successful investing.

We encourage you to share your thoughts and experiences in the comments below. Additionally, feel free to explore other articles on our site for more insights into the stock market and financial planning. Your feedback and engagement help us create content that better serves your needs as an investor.

Data Source: Tesla Investor Relations, SEC Filings, and Statista.