In the ever-evolving world of financial markets, Tesla Inc. has emerged as a powerhouse that continues to shape the future of both the automotive and energy sectors. The term "TSLA quote" refers to the real-time stock price of Tesla Inc., a critical parameter for investors and enthusiasts alike who wish to track the company's performance on the stock market. Understanding what drives the TSLA quote and how it fluctuates is essential for anyone looking to engage with Tesla's financial journey.

Tesla, founded in 2003, has grown from a niche electric vehicle manufacturer into a global leader in sustainable energy solutions. The company's stock, symbolized as TSLA, is one of the most actively traded stocks on the NASDAQ. Investors are keenly interested in the TSLA quote because it reflects not only Tesla's financial health but also the broader trends in the technology and automotive industries.

As we delve deeper into the world of Tesla's stock market performance, this article will provide a comprehensive analysis of the TSLA quote, including its historical context, factors influencing its value, and strategies for interpreting its movements. Whether you're a seasoned investor or a newcomer to the stock market, this guide will equip you with the knowledge to make informed decisions about Tesla's stock.

Read also:Exploring The Wonders Of Science At The Ct Science Center Hartford Ct

Table of Contents

- Introduction to TSLA

- Understanding the TSLA Quote

- Factors Affecting the TSLA Quote

- Historical Performance of TSLA

- Market Analysis: TSLA Stock

- Investment Strategies for TSLA

- Risk Management in TSLA Investments

- Long-Term Potential of TSLA

- Tesla Beyond Vehicles

- Conclusion

Introduction to TSLA

Tesla Inc., founded by a group of engineers in 2003, revolutionized the automotive industry with its commitment to producing electric vehicles (EVs). The company's mission is to accelerate the world's transition to sustainable energy. Over the years, Tesla has expanded its product offerings to include solar energy solutions, energy storage systems, and autonomous driving technology.

Tesla's stock, symbolized as TSLA, has become a symbol of innovation and growth in the financial markets. The TSLA quote represents the current trading price of Tesla's shares on the stock exchange. Investors closely monitor this figure as it provides insights into the company's market valuation and investor sentiment.

Tesla's Mission and Vision

Tesla's mission extends beyond manufacturing electric cars. The company aims to create an ecosystem of sustainable energy solutions. This includes:

- Electric vehicles (Model S, Model 3, Model X, Model Y)

- Solar panels and solar roof tiles

- Energy storage solutions like Powerwall and Powerpack

- Autonomous driving technology through Full Self-Driving (FSD)

Understanding the TSLA Quote

The TSLA quote refers to the current market price of Tesla's stock, which is influenced by various factors such as supply and demand, company performance, and broader market trends. Understanding the TSLA quote involves analyzing its components and the mechanisms that drive its fluctuations.

Components of the TSLA Quote

The TSLA quote includes several key elements:

- Opening Price: The price at which TSLA stock begins trading for the day.

- Closing Price: The final price at which TSLA stock trades before the market closes.

- High and Low: The highest and lowest prices reached by TSLA stock during the trading day.

- Volume: The number of shares traded during the day, indicating market activity.

Factors Affecting the TSLA Quote

The TSLA quote is subject to numerous influences, both internal and external. Understanding these factors is crucial for predicting stock price movements.

Read also:What Is Hd Have 4u A Comprehensive Guide To Understanding Its Features And Benefits

Internal Factors

Internal factors that affect the TSLA quote include:

- Company earnings reports

- Product launches and updates

- Management decisions and strategic partnerships

External Factors

External factors influencing the TSLA quote are:

- Economic conditions and interest rates

- Global events and geopolitical tensions

- Industry trends and competitive dynamics

Historical Performance of TSLA

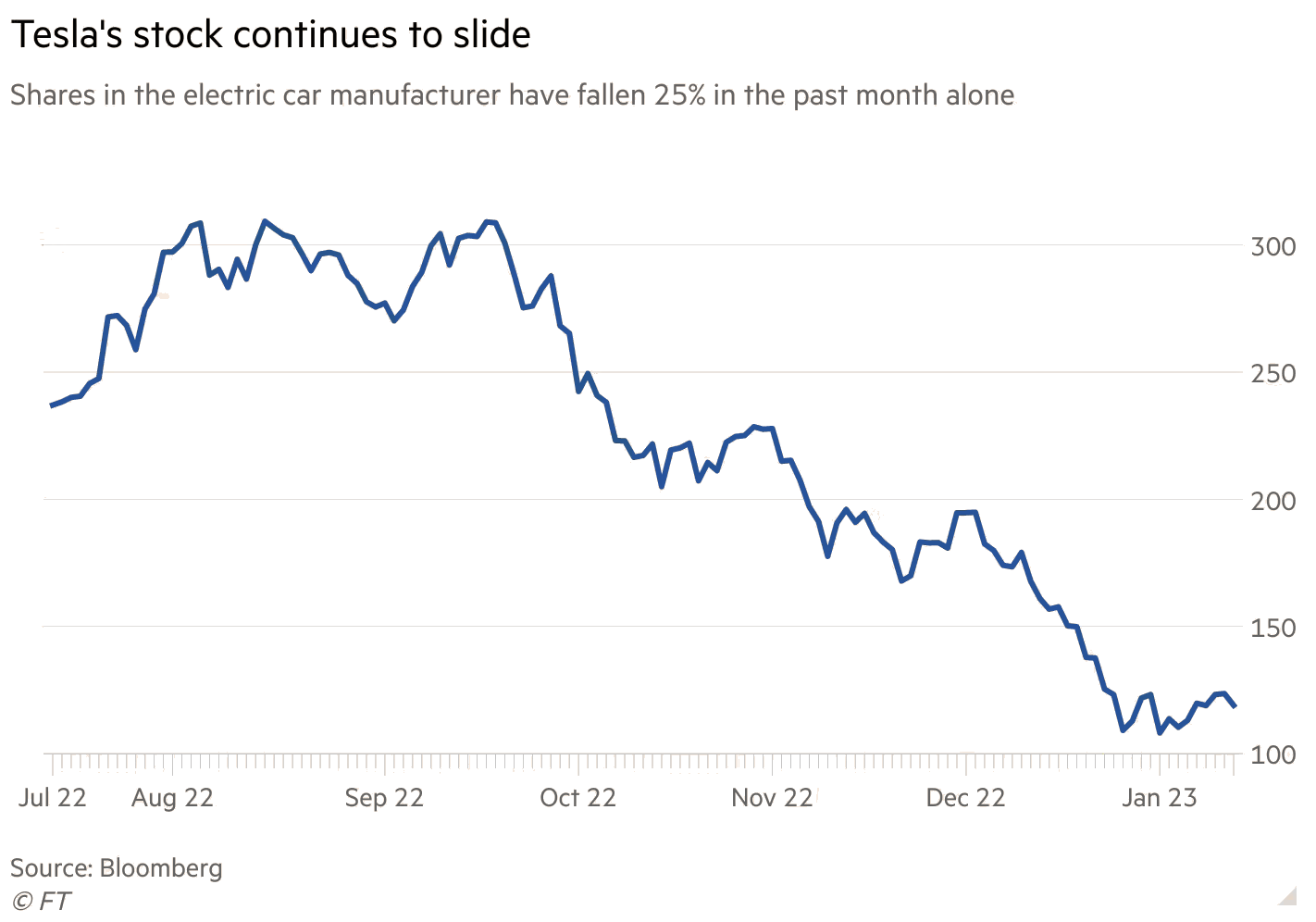

Tesla's stock has experienced remarkable growth since its initial public offering (IPO) in 2010. The TSLA quote has seen significant fluctuations, reflecting the company's rapid expansion and occasional challenges.

According to data from Statista, Tesla's stock price has increased by over 1,000% since its IPO, making it one of the most successful IPOs in history. This growth is attributed to Tesla's innovation, market leadership, and expanding product portfolio.

Market Analysis: TSLA Stock

Analysts use various metrics to evaluate the TSLA quote and predict future performance. Key indicators include price-to-earnings (P/E) ratio, earnings per share (EPS), and market capitalization.

As of the latest reports, Tesla's market capitalization exceeds $1 trillion, solidifying its position as one of the most valuable companies globally. This valuation reflects investor confidence in Tesla's long-term growth potential.

Investment Strategies for TSLA

Investing in TSLA requires a strategic approach due to the stock's volatility. Investors can adopt several strategies to optimize their returns:

Long-Term Investing

Holding TSLA stock for the long term can yield substantial returns, as the company continues to innovate and expand its market share.

Short-Term Trading

Short-term traders can capitalize on TSLA's price volatility by timing their entries and exits based on market trends and technical analysis.

Risk Management in TSLA Investments

Investing in TSLA comes with inherent risks, including market volatility and regulatory challenges. Effective risk management strategies include:

- Diversifying your investment portfolio

- Setting stop-loss orders to limit potential losses

- Staying informed about Tesla's financial performance and industry developments

Long-Term Potential of TSLA

Tesla's long-term potential is driven by its commitment to innovation and sustainability. The company is poised to benefit from the global shift towards electric vehicles and renewable energy solutions.

Research from McKinsey & Company suggests that the EV market will continue to grow rapidly, with Tesla at the forefront of this transformation. This growth is expected to positively impact the TSLA quote in the coming years.

Tesla Beyond Vehicles

Tesla's impact extends beyond the automotive industry. The company's energy solutions, such as solar panels and energy storage systems, are reshaping how we generate and consume energy.

By diversifying its product offerings, Tesla aims to create a comprehensive ecosystem of sustainable energy solutions. This diversification enhances the company's resilience and growth prospects, further influencing the TSLA quote.

Conclusion

In conclusion, the TSLA quote is a critical parameter for understanding Tesla's financial performance and market position. By analyzing the factors influencing the TSLA quote and adopting strategic investment approaches, investors can make informed decisions about Tesla's stock.

We invite you to share your thoughts and experiences with TSLA investments in the comments section below. Additionally, explore other articles on our site for more insights into the financial markets and investment strategies.